Responsible Borrowing

Everything You Need to Know About Credit Cards

Sep 28, 2021 Updated Jan 9, 202315 min read

Summary

- Credit cards are a versatile tool that can be used to simplify your finances.

- All credit cards are not the same, and there are some potential benefits and drawbacks to carefully consider.

How Credit Cards Work

Like most Americans, you’ve probably owned a credit card or two in your adult life. But have you ever fully explored the ins and outs of how credit cards work? Surprisingly, many of us haven’t. That’s why we’ve put together this credit card tutorial covering everything you need to know about credit cards before you apply for your next one. Find out how credit cards work, what to look for, what to avoid, and how to use them as a tool to improve your credit score and reach your financial goals.

Types of Credit Cards

Although there are many types of credit cards on the market, they traditionally fall into three main categories: unsecured, secured, and retail. Let’s take a look at each type and who they may be best for.

Unsecured credit cards

Unsecured credit cards are the most common type of card, making up the vast majority of credit cards on the market today. They’re a form of revolving credit, which means they offer a line of credit with a cap of a certain amount. Pay the full balance on the card each month and you won’t incur interest charges. If, however, you carry a balance from month to month, you’ll pay interest on that balance.

Secured credit cards

A secured credit card is one that requires you to put down a security deposit as a form of collateral in case you default on your monthly payments. Secured cards are ideal for people who are trying to build credit (e.g., those with limited or no credit) or rebuild credit (e.g., those with credit damage who want to repair it).

Retail credit cards

Retail credit cards are cards offered by specific retailers, like Target or Amazon. They come in two main forms: co-branded and closed-looped. A co-branded retail card is partnered with a large network such as Visa or Mastercard and can be used anywhere you’d use a non-retail card. Conversely, a closed-loop retail card features the store’s logo and can only be used at that specific retailer, either in-store or online. Closed-loop cards may be easier to qualify for than traditional credit cards. These cards usually come with higher APRs than many non-retail cards but don’t typically charge an annual fee.

What Are Credit Cards Used For?

Credit cards have evolved a lot over the last few decades. The most common use of a credit card is to purchase things, whether it’s a six-pack of toothpaste on Amazon or a round-trip flight to your favorite destination. Buying things with a credit card can be more convenient than using cash, but it’s important to remember that purchasing things on your credit card still means paying for them — potentially with interest, if you don’t pay off the balance each month.

In addition to being a purchasing tool, credit cards can also be used for emergencies, balance transfers, cash advances, and building credit. To fully understand how credit cards work and how to make them work for you, it’s important to take a closer look at their benefits, various costs, and potential disadvantages.

Benefits of Owning a Credit Card

Many Americans use their credit cards for a specific purpose without knowing the full use of this financial tool. Here are some of the benefits of owning a credit card.

Building credit

Having good credit can help you with some of life’s big financial milestones, such as taking out a mortgage for a home. So how do you get good credit? By responsibly managing the credit that’s already been extended to you. Many factors make up your credit score, but the ones that have the most significant impact are your payment history and the amount of credit you’re using. This means, at minimum, making sure to pay your credit card bills on time, spending within your means so you can afford to pay your full balance each month, and keeping your credit utilization low.

Emergencies

Ideally, every family should have an emergency savings fund set up for unexpected events like a sudden job loss or essential medical procedure. However, the reality is that many Americans are not prepared for financial emergencies. This is when a credit card can be a (temporary!) lifesaver. Some people choose to keep credit cards around for emergencies only.

Balance transfers

Another use for a credit card is a balance transfer. Sometimes a card will offer a special low rate, such as during an introductory period for a new card or during special promotion of an active credit card. If you transfer the balance from a higher interest rate card to take advantage of the lower rate, you can reduce or eliminate interest charges for a period of time so more of your debt payments go to principal instead of interest.

The caveat is that you need to continue paying at least as much each month as you were on the old card. This enables you to reduce your total debt due to the lower amount of interest paid.

Other benefits

Credit cards also offer a number of perks that you may not get elsewhere. Many cards offer rewards like cash back on purchases or travel miles. You can also benefit from the consumer protections that come with some cards, such as zero liability if someone steals your card to make fraudulent charges. There are also instances where credit is the only form of payment accepted, or you need a card to hold a reservation at a restaurant or hotel.

Risks of Owning a Credit Card

Misusing credit cards can do a number on your financial health and outlook. Here are the major pitfalls to avoid when paying with a credit card.

Overspending

Overspending is a common issue for people who are new to credit card use. When you see that credit limit for the first time, it’s hard not to look at it as free money even though you know it’s not. To avoid overspending, experts recommend the following:

- Set a monthly limit for non-essential purchases

- Wait 24 hours before completing impulse buys online

- Leave your credit cards at home whenever possible

- Ensure your card info isn’t stored on shopping websites for too-easy access

Long-term repayment leads to a high cost

If you pay your credit card balances in full each month, you can avoid interest charges altogether. Unfortunately, this can be easier said than done. When you carry balances on your cards from month to month — particularly large ones — you build up interest charges on the portion of your balance rolling over from the previous month.

To that end, it’s important to note that making only the minimum payment each month can cause trouble in the long run. While it can help you avoid late fees, a minimum payment may barely make a dent in your balance — which means you’ll be in debt for a long time and spend a lot of money on interest.

Damage to your credit

The potential for harming your credit score is the unfortunate flipside to the potential credit-building benefits of card ownership. Just as using a card responsibly can help boost your credit score, using it unwisely can damage it. If you have a high utilization rate on your credit cards, your score will drop. You can generally expect that for each 10% increase in your utilization rate, your credit score could drop by 5 to 15 points.

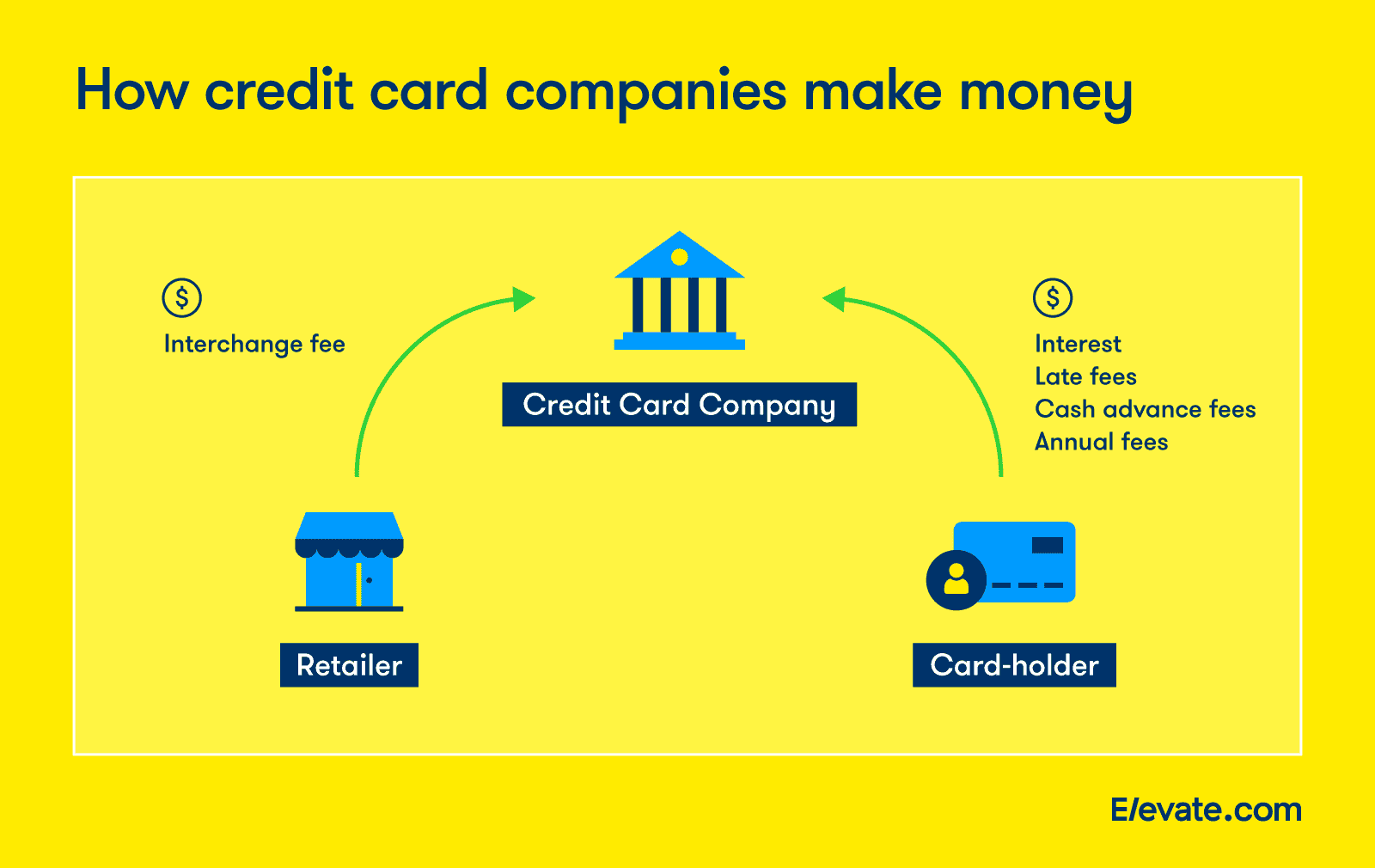

Costs of Owning a Credit Card

In addition to interest charges, there are several other fees to be aware of when applying for and using credit cards.

Annual fees

Many credit cards come with an annual fee. Depending on your credit health and what you intend to use the card for, the fee may be worthwhile. For example, some secured cards charge an annual fee, but if you’re using the card to improve your credit and establish a positive payment history, the fee may be justifiable in light of the card’s benefits. Similarly, some unsecured cards with annual fees offer a number of perks that can outweigh the fee — particularly if you use the card frequently and pay your balance in full each month. If a particular card charges a reasonable annual fee to access the benefits you’re looking for, it may be a good option.

Cash advance fees

A cash advance on a credit card is a way to withdraw actual cash from your card rather than using it for a purchase. However, cash advances are expensive. They usually include either a flat fee or a percentage of the transaction — whichever is greater. Cash advances also have their own interest rates, and they’re typically higher than the rate you’re charged for purchases, with no interest-free grace period. Additionally, you may have to pay an ATM fee when you make your withdrawal. Cash advances can come in handy if you need to cover a cash shortfall, but be aware that there are other options available to you.

Other charges and fees

There are a number of other types of credit card fees that issuers may charge depending on how and when you use your card.

- Late payment fees. If you miss a payment, even by just one day, you’ll likely get charged a fee.

- Foreign transaction fees. This is a fee that certain credit card issuers charge when you use your card in another country. Foreign transaction fees are typically around 3% of each transaction in US dollars.

- Over-the-limit fees. Just as your bank can charge you fees if you overdraw your account, credit card companies can charge you fees if you exceed your credit limit. These fees usually occur if you’ve opted in to over-the-limit transactions, which means your card won’t be declined if you go over your limit.

How to Apply for a Credit Card

If you are considering applying for a credit card, here are just a few more things to consider before taking the plunge.

Before you apply

As a general guideline, you need a minimum credit score of about 600 to get approved for an unsecured credit card. However, some lenders will approve customers with lower scores or no score at all. If your score is lower or you’re working on building your credit, you may want to apply for a secured credit card instead. Secured and unsecured cards can both help you build credit when used in a specific way.

Pre-approved vs. pre-selected

Credit card issuers often send invitations to apply in the mail. What they say in that piece of mail will often indicate how likely you are to be approved. When lenders tell you that you have been pre-approved or pre-qualified, it means that they have already reviewed your credit through a pre-screening process, and you are very likely to be approved. If your letter states that you are pre-selected, that usually means the lender knows very little about your credit situation. Your chances of being approved depend on your credit situation and the lender’s criteria.

Regardless of the type of offer, do your research about the lender and only apply for cards that are suitable for your needs.

Where to apply

These days, most credit cards have an online application process, which you typically access through the provider’s site. If you’re applying for a credit card with your bank, you may be able to go into the branch to submit an application using a paper form. And some cards will allow you to apply over the phone, but keep in mind you may still need to provide documentation, such as your ID, using either an online portal or via fax/email.

If you’re applying online, be aware that there’s a difference between a provider’s direct site and a lead aggregator or broker. The former will very clearly have the credit card provider’s branding and legalese all over the site, while the latter may serve up several credit card offers from different providers based on your personal information. If you already know which card you want, using the lenders site is a good idea. If you are shopping for the best rate or rewards you are eligible for, then an aggregator or broker may be a good option for you.

The Bottom Line

Credit cards can be a great financial tool for millions of people. At the same time, they can create issues when they are misunderstood or not used wisely. Before getting and using a credit card make sure that you:

- Understand all the costs of the card

- Know how you will use it to improve your financial life

- Have a plan to pay the balance each month

- Know how they affect your credit score.

If you’re shopping for a credit card, familiarize yourself with all the benefits, weigh them against the associated costs and choose a card that has the right benefits for your specific needs.

About the author

Nathan Foley questions everything — and thinks you should too. As Elevate’s resident mathematician, he pores over datasets to find the truth amid the fluff and translates insights into ideas for improving personal financial resilience.